This trading algorithm uses a higher timeframe breakout zone to identify a bias on a lower timeframe.

If the lower timeframe zone breaks in the same direction as the higher timeframe zone breakout, the algorithm uses a full lot size to enter the trade.

If the lower timeframe zone breaks in the opposite direction of the higher timeframe zone breakout, the algorithm uses a half lot size to enter the trade.

Rationale: (Trading Algorithm: Using Higher Timeframe Breakout Zone for Bias)

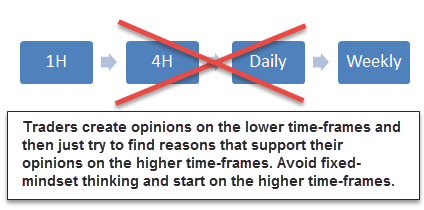

The rationale behind this algorithm is that the higher timeframe breakout zone is more likely to be significant than the lower timeframe zone.

Therefore, if the lower timeframe zone breaks in the same direction as the higher timeframe zone breakout, it is more likely that the move will continue.

However, if the lower timeframe zone breaks in the opposite direction of the higher timeframe zone breakout, it is more likely that the move will be false.

Trading Algorithm: Using Higher Timeframe Breakout Zone for Bias

The following is a step-by-step guide to using the algorithm:

- Identify a higher time frame breakout zone.

- Identify a lower time frame zone within the higher timeframe breakout zone.

- If the lower time frame zone breaks in the same direction as the higher timeframe zone breakout, enter a trade with a full lot size.

- If the lower time frame zone breaks in the opposite direction of the higher time frame zone breakout, enter a trade with a half lot size.

- Place a stop loss order below the lower time frame zone breakout level.

- Monitor the trade and exit when the take profit target is reached or when the stop loss order is triggered.

Optimizations (Trading Algorithm: Using Higher Timeframe Breakout Zone for Bias)

Here are a few optimizations that can be made to the algorithm:

- Use a risk-reward ratio to determine the take profit target.

For example, you might aim for a 2:1 risk-reward ratio, which means that you would aim to make twice as much money as you risk on each trade. - Use a trailing stop loss order to protect your profits. A trailing stop loss order will automatically move up as the price moves in your favor, which can help you to protect your profits.

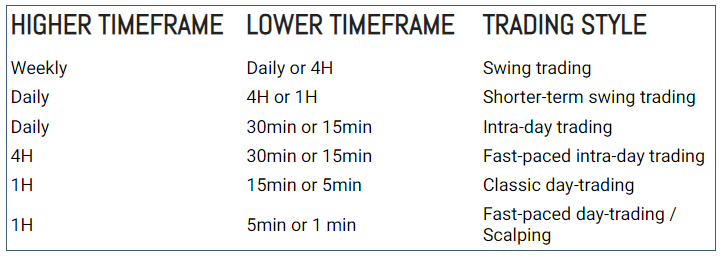

- Use multiple timeframes to identify the higher time frame breakout zone and the lower time frame zone.

For example, you might use the daily chart to identify the higher time frame breakout zone and the 4-hour chart to identify the lower time frame zone.

Conclusion

This trading algorithm can be a useful way to identify trading opportunities and manage risk. However, it is important to note that no trading algorithm is guaranteed to be profitable. It is always important to risk only what you can afford to lose.

Additional Tips (Trading Algorithm: Using Higher Timeframe Breakout Zone for Bias)

Backtest the algorithm before using it in a live trading environment. Backtesting involves using historical data to test the performance of the algorithm.

This can help you to identify any potential problems with the algorithm before you risk any money.

Use the algorithm in conjunction with other technical analysis tools. For example, you might use Fibonacci retracement levels or Elliott wave theory to identify potential take profit targets.

Be patient and disciplined when using the algorithm. Don’t overtrade and don’t abandon the algorithm after a few losses.

POSTED IN: Online Trading for Beginners