One way to maximize the potential of a market move is to make two entries.

The first entry can be made immediately after the zone candle breakout, and the second entry can be made after the price has moved +50% of the zone breakout.

This strategy can be used for both long and short trades.

For example, if you are looking to take a long trade, you would enter the trade immediately after the price breaks out above the resistance zone.

You would then place a second entry order +50% above the resistance zone.

If the price continues to move up, you will have two positions that are profitable. If the price pulls back, you will still have one position that is profitable.

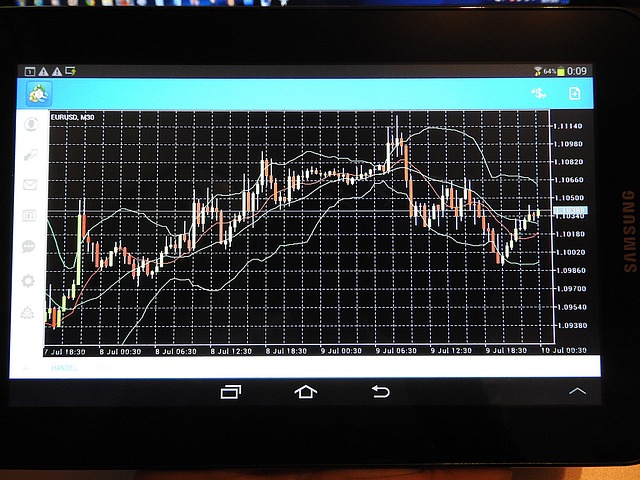

Here is an example of how to use this strategy to make two entries to maximize the potential of a market move:

Long Trade (Making Two Entries to Maximize Potential Market Move)

- Identify a trading zone with a clear resistance level.

- Place a buy order immediately above the resistance level.

- Place a second buy order +50% above the resistance level.

- Once the price breaks out above the resistance level, your first buy order will be executed.

- Once the price moves +50% above the resistance level, your second buy order will be executed.

- Place a stop-loss order below the resistance level to protect your profits.

- Monitor the market closely and be prepared to exit your trades if the price pulls back below the resistance level.

Short Trade (Making Two Entries to Maximize Potential Market Move)

- Identify a trading zone with a clear support level.

- Place a sell order immediately below the support level.

- Place a second sell order -50% below the support level.

- Once the price breaks out below the support level, your first sell order will be executed.

- Once the price moves -50% below the support level, your second sell order will be executed.

- Place a stop-loss order above the support level to protect your profits.

- Monitor the market closely and be prepared to exit your trades if the price pulls back above the support level.

It is important to note that this strategy is not without risk. If the price pulls back after you have made your first entry, you could lose money.

However, by making a second entry after the price has moved +50% of the zone breakout, you can reduce your risk and maximize your potential profit.

Here are some additional tips for using this strategy:

- Use a stop-loss order to protect your profits.

- Use a take-profit order to lock in your profits.

- Use a trailing stop-loss order to follow your profits.

- Monitor the market closely and be prepared to exit your trades if the price pulls back below the resistance level or above the support level.

By following these tips, you can increase your chances of success and reduce your losses when using this strategy to make two entries to maximize the potential of a market move.

POSTED IN: Online Trading for Beginners